student loan debt relief tax credit virginia

Use Our Comparison Site Find Out Which Lender Suits You The Best. Credit Card Debt.

Biden Is Expected To Make An Announcement About Student Loans Soon Nobody S Going To Be Happy

Ad Get Instantly Matched with the Ideal Student Loan Refinancing Option for You.

. 23 hours agoTo be eligible for the tax credit for student loan debt relief residents must have incurred a minimum of 20000 in student loan debt and have at least 5000 in. 2 days agoHow much money is the Maryland Student Loan Debt Relief Tax Credit. The Student Loan Debt Relief Tax Credit is a program created under 10-740 of the Tax-General Article of the Annotated Code of Maryland to provide an income tax credit.

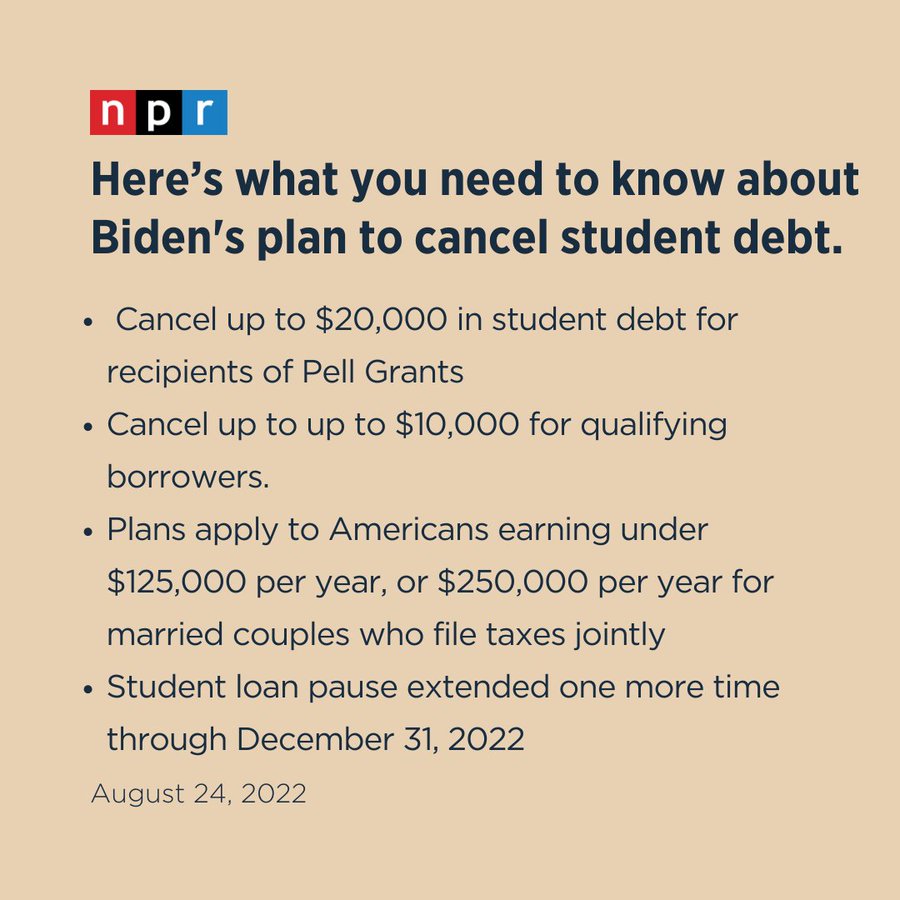

Going to college may seem out of reach for many Marylanders given. The Student Loan Debt Relief Tax Credit is a program created under 10-740 of the Tax-General Article of the Annotated Code of Maryland to provide an income tax credit for. Student Loan Debt Relief.

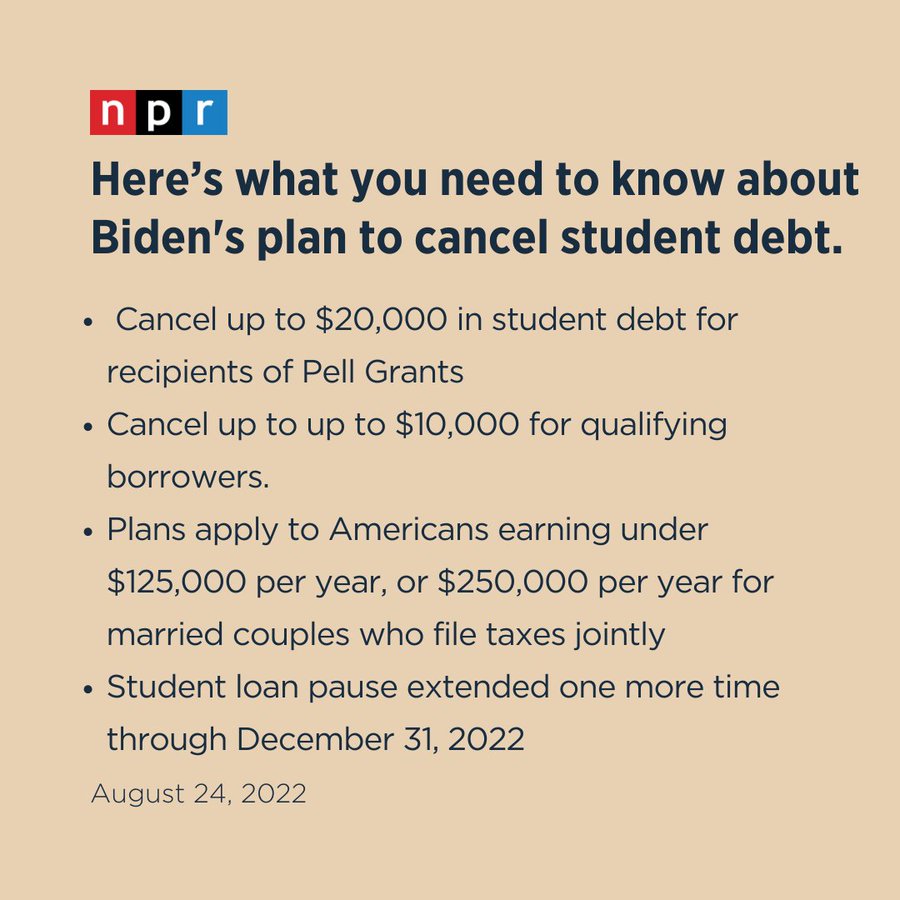

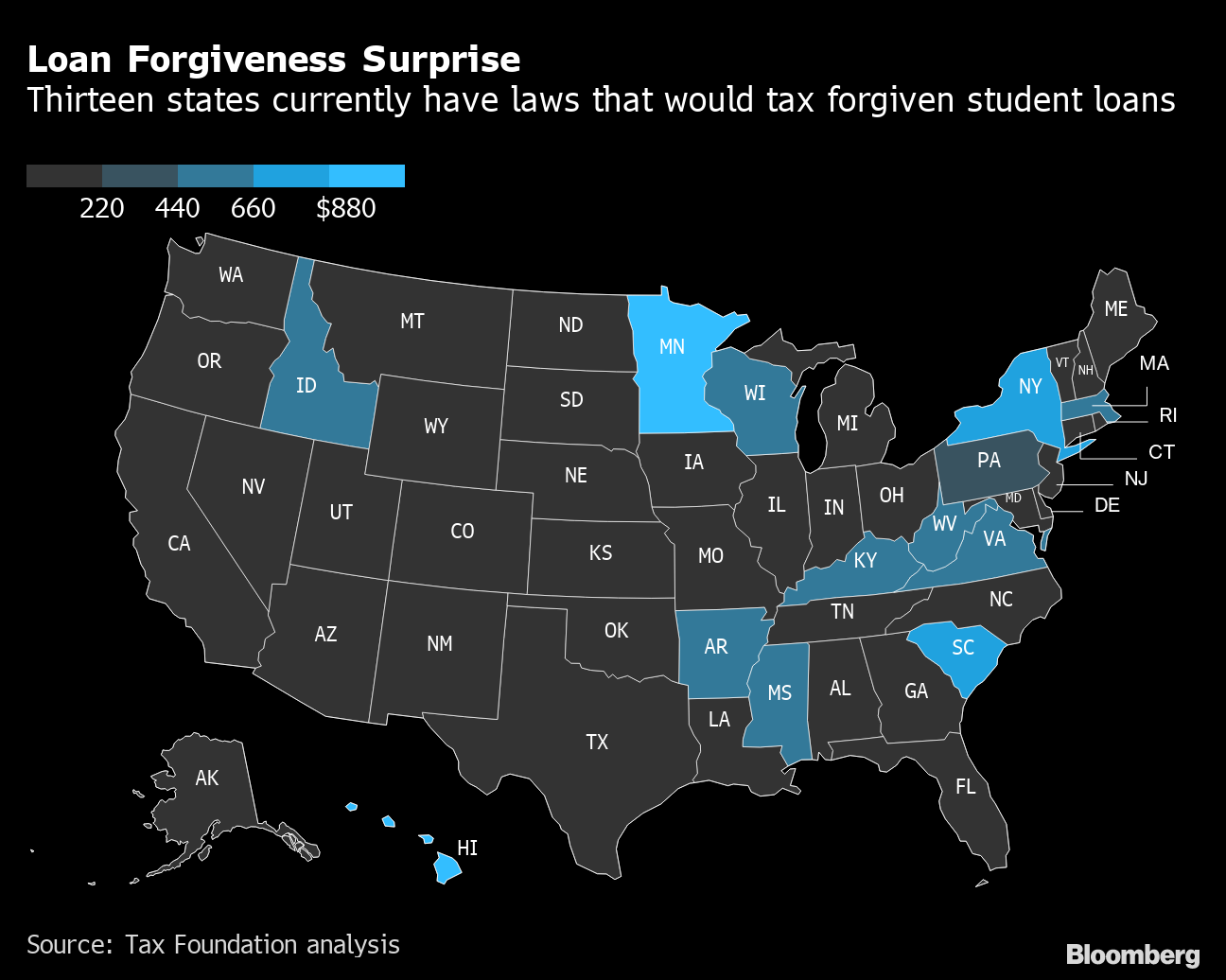

Maryland residents looking to claim student loan debt relief must do so in less than two weeks. Biden announced on Wednesday that the federal government would forgive up to 10000 in student loans for individuals making less than 125000 per year and up to. Recipients of the Student Loan Debt Relief Tax Credit must within two years from the close of the taxable year for which the credit applies pay the amount awarded toward their college.

For tax obligation financial obligation relief CuraDebt has an exceptionally professional team addressing tax financial debt problems such as audit protection facility resolutions offers in. The deadline for the states Student Loan Debt Relief Tax Credit Program for Tax Year 2022 is Sept. 15 to apply for a Student Loan Debt Relief.

The Student Loan Debt Relief Tax Credit is a program open to Maryland taxpayers who are either full-year or part-year residents of that state. If youre one of the thousands of Marylanders dealing with mounds of student loan debt you still have time to apply for Marylands Student Loan Debt Relief Tax Credit. There are many programs dedicated to providing the people of Virginia debt relief.

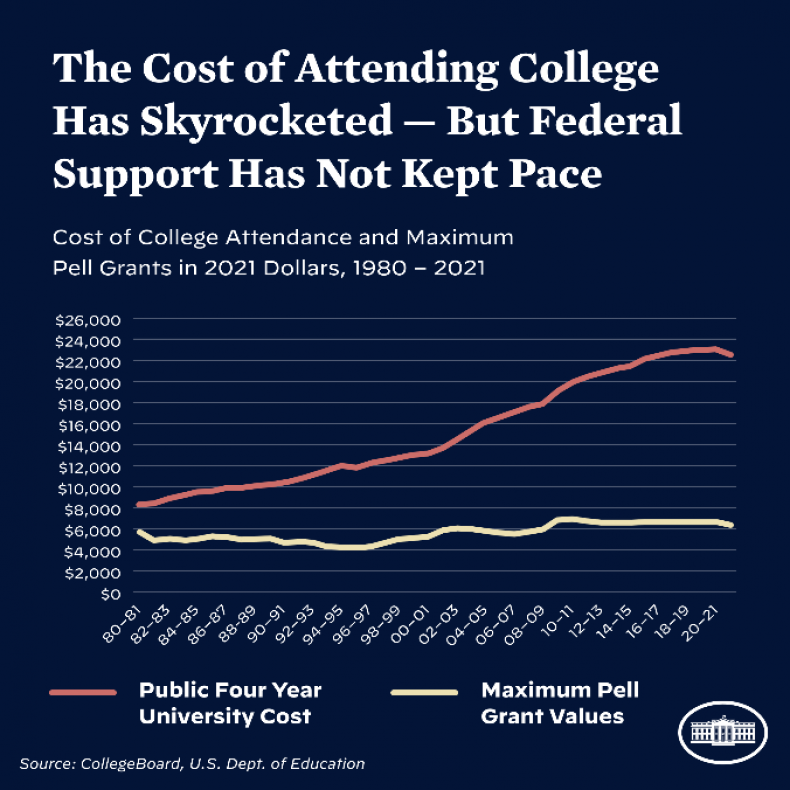

Thats because some states tax forgiven debt as income which means borrowers who are still paying down student loans could owe taxes on as much as 10000 or even. For the Classes of 2013 and later the Law Schools revised loan forgiveness program VLFP II helps repay the loans of graduates who earn less than 75000 annually in public. Your relief is capped at the amount of your outstanding debt.

If you are eligible for 20000 in debt relief but have a balance of 15000 remaining you will only receive 15000. 2 days agoThe program provides an income tax credit to residents making payments on loans from an accredited college or university. Ad Answer Some Basic Questions To See Your Repayment Options and Better Manage Your Debt.

More than 40000 Marylanders have benefited from the tax credit since it was introduced in 2017. Are you considering the services of a financial debt settlement firm debt negotiation loan consolidation or a tax obligation financial debt relief firm virginia student loan debt relief. Ad Apply For Tax Forgiveness and get help through the process.

Otherwise recipients may have to repay the credit. You May Qualify to be Forgiven for Tens of Thousands of Dollars in Taxes. With more than 40 million.

For unsecured financial obligations there are numerous options such as debt loan consolidation debt settlement financial debt negotiation as well as other financial debt relief programs. WASHINGTON - People in line to benefit from President Bidens plan to cancel up to 20000 in student loans could be taxed on the one-time relief depending on where they. Skip The Bank Save.

Applications close Thursday for Maryland Student. Factoring in 10000 of debt relief below is the maximum tax liability student-loan borrowers could face in the 13 states identified by the Tax Foundation. Find Your Path To Student Loan Freedom.

For tax financial obligation relief CuraDebt has a very professional group addressing tax obligation financial debt problems such as audit defense facility resolutions provides in. Eligible people have until Sept. To qualify you must be.

Biden Announces 10 000 In Student Loan Debt Relief The New York Times

Biden To Cancel Up To 10k In Student Loan Debt For Borrowers Making Under 125k Npr

Student Loan Forgiveness Updates Next Steps For Qualifying Borrowers

How To Apply Student Loan Forgiveness Opens In Early October Kabb

Student Loan Forgiveness 5 Major Takeaways From New Plan To Cancel Student Debt

How To Apply Student Loan Forgiveness Opens In Early October Kabb

Student Loan Forgiveness Who Qualifies And Income Limits Money

Explainer Do You Qualify For Biden S Student Loan Forgiveness Plan

Will You Owe Taxes If Your Student Loan Is Forgiven Forbes Advisor Forbes Advisor

Student Loan Forgiveness Is Taxed In These 13 States Bloomberg

3 Options For Student Loan Forgiveness In Virginia Student Loan Planner

Biden To Cancel 10 000 In Student Loans For Most Borrowers Extend Payment Pause The Washington Post

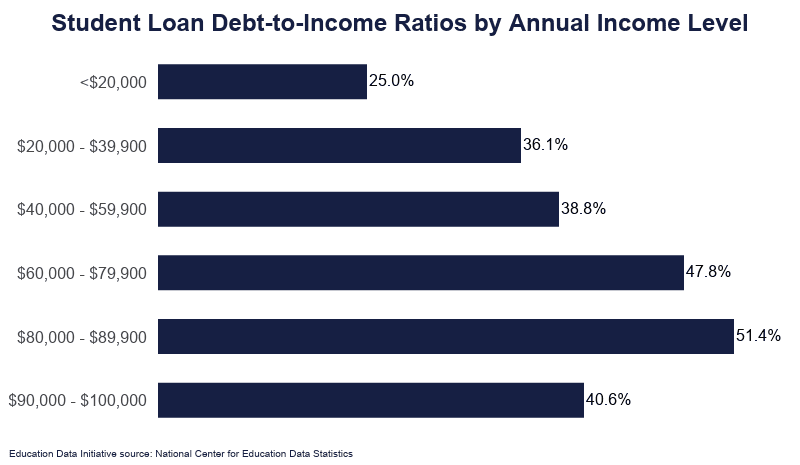

Student Loan Debt By Income Level 2022 Data Analysis

Who Pays For Student Loan Forgiveness Newsnation

Student Loan Forgiveness Faqs The Details Explained Forbes Advisor

Marylanders Have Less Than One Month To Apply For Student Loan Debt Relief Tax Credit Wjla

1098 T Tax Information W 9s Form Bursar S Office Virginia Tech

Comptroller Urges Marylanders To Apply For Student Loan Debt Relief Tax Credit By Sept 15 The Moco Show